Unlike listed companies, private entities don’t have the same transparency requirements. This makes sourcing their financial data challenging but invaluable for strategic decision-making. With CloudSmartfinance, you gain exclusive access to this information, enabling you to make data-driven decisions with confidence.

Case study

Let us review a recent significant European acquisition – Swisscom’s acquisition of Vodafone Italia, set to take place in early 2025. This acquisition, valued at approximately $8.6 billion, is part of Swisscom’s strategy to expand its telecommunications footprint in Italy by integrating Vodafone Italia with its existing subsidiary, Fastweb. The deal aims to create Italy’s second-largest broadband operator, enhancing service delivery and competitiveness in the market.

Target private company here, Vodafone Italia,

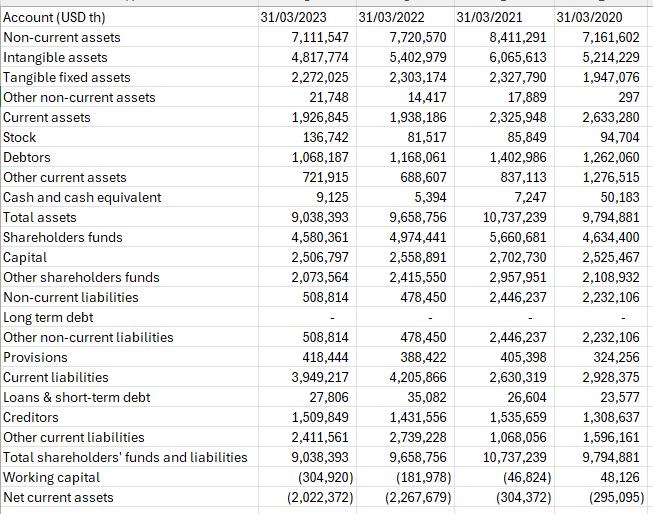

Balance sheet: (sourced from its audited annual report) which is not available publicly

The balance sheet data for Vodafone Italia S.p.A. here provides key insights into the company’s financial health and operational structure. The notable important elements and how they could be analyzed to understand potential risks or opportunities from reading its annual accounts,

1. Assets Analysis

- Non-Current Assets: These have shown a decline from $8.41 billion in 2021 to $7.11 billion in 2023. The reduction in intangible assets, which include licenses, trademarks, and technology, could indicate impairment or asset write-downs, potentially due to technology obsolescence or competitive pressures. It may also reflect a reduced investment in long-term growth assets.

- Current Assets: Relatively stable, but with a slight decline over the years. The small proportion of cash and cash equivalents ($9.1 million in 2023) indicates low liquidity, suggesting that the company may rely heavily on its operations to fund short-term obligations.

2. Liabilities Analysis

- Non-Current Liabilities: Significant volatility is observed, especially with a spike in 2021 ($2.45 billion) compared to other years. This fluctuation could be associated with restructuring efforts, provisions for legal or regulatory risks, or changes in long-term contracts. Provisions, a large part of non-current liabilities, remain considerable, indicating that Vodafone Italia might be preparing for potential legal or financial obligations.

- Current Liabilities: Increased to $3.95 billion in 2023. A notable concern is the high level of other current liabilities, which may include deferred revenue, taxes payable, and other short-term obligations. A comparison with current assets suggests potential liquidity stress, as current liabilities exceed current assets substantially, leading to negative net current assets.

3. Equity Position

- The decline in shareholders’ funds from $5.66 billion in 2021 to $4.58 billion in 2023 shows erosion in equity, possibly due to losses or distributions exceeding profits. This could be a signal of declining profitability or challenges in maintaining sustainable margins.

4. Working Capital and Net Current Assets

- Both working capital and net current assets are negative, indicating that Vodafone Italia may struggle with liquidity. The negative net current assets of -$2.02 billion in 2023 imply that the company has more short-term liabilities than it can cover with short-term assets, potentially leading to refinancing needs or restructuring.

5. Key Observations for M&A or Due Diligence

- Risk Identification: The decline in equity, negative working capital, and fluctuating liabilities could raise red flags for investors or acquirers. These metrics suggest the need for a closer look at the reasons behind the asset impairments, provision levels, and debt restructuring activities.

- Valuation Considerations: Given the financial structure, an acquirer might discount the valuation to account for potential cash flow challenges and the need for further investment to stabilize operations.

- Opportunities: If the underlying issues causing these fluctuations (e.g., asset impairments or high provisions) are resolvable, there may be an opportunity to acquire Vodafone Italia at a discounted price and restructure it for improved profitability.

The below insights are based on the P&L (sourced from its audited annual report) which is not available publicly

1. Revenue Trends

- Operating Revenue: Vodafone Italia’s operating revenue has been declining over the past four years, from $6.76 billion in 2020 to $5.73 billion in 2023. This consistent decrease indicates challenges in maintaining customer growth or pricing power, possibly due to increased competition, market saturation, or shifts in consumer behavior toward alternative services (e.g., digital communication apps replacing traditional services).

- Sales Decline: Sales, a key component of operating revenue, have also shown a similar decline pattern, suggesting Vodafone Italia may be losing market share or struggling to retain customers at previous price levels.

2. Cost of Goods Sold (COGS) and Gross Profit

- COGS: The cost of goods sold decreased from $799 million in 2020 to $592 million in 2023. While reducing COGS can be positive, in this context, it might be a reflection of declining sales volume rather than cost efficiencies. A closer look into the nature of these costs is necessary to determine if cost management efforts are being effectively implemented.

- Gross Profit: The gross profit has also been decreasing, which aligns with the drop in revenue. The decline from $5.96 billion in 2020 to $5.14 billion in 2023 shows that despite some reduction in COGS, Vodafone Italia has not been able to protect its margins effectively. This suggests that the decrease in revenue is having a direct and negative impact on profitability.

3. Operating Profit (EBIT) and Operational Challenges

- EBIT: Vodafone Italia reported a negative EBIT in 2023 and 2022 (-$320 million and -$104 million, respectively). This is a significant decline compared to a positive EBIT of $404 million in 2020. This negative operating profit indicates operational inefficiencies and higher costs relative to revenue. The decline points to potential challenges, such as increased competition, higher operating expenses, or reduced pricing power, which are impacting the company’s ability to generate profits from its core operations.

- The consecutive negative EBIT figures highlight a need for restructuring or cost optimization to regain operational efficiency. This might also indicate that the company is facing difficulties in adapting to changing market conditions or managing operational costs effectively.

4. Net Income and Profitability Concerns

- Net Income: The company has been consistently reporting losses since 2021. The net loss widened from $1.5 million in 2021 to $271 million in 2023. This trend shows that the business is not generating sufficient revenue to cover its costs, including operating and financial expenses.

- Profit Before Tax (PBT): The PBT also moved from a positive $372 million in 2020 to a negative $358 million in 2023. The decline suggests that Vodafone Italia’s challenges are not only operational but may also involve increased financial burdens or inefficiencies that impact the bottom line.

5. EBITDA and Cash Flow Analysis

- EBITDA: The EBITDA figures, although positive, have declined from $2.04 billion in 2020 to $1.28 billion in 2023. This shows a reduction in the company’s ability to generate cash from its operating activities, even before accounting for interest, taxes, depreciation, and amortization. While EBITDA is still positive, the downward trend suggests that Vodafone Italia’s core business is becoming less efficient and profitable over time.

- Cash Flow: Similarly, cash flow has decreased from $1.9 billion in 2020 to $1.33 billion in 2023. The decline in cash flow mirrors the issues seen in EBITDA and overall profitability, indicating that Vodafone Italia’s ability to generate cash from its operations is deteriorating.

6. Key Takeaways

- Revenue Decline: Vodafone Italia needs to address the decline in revenue, which may involve revising its product offerings, pricing strategies, or improving customer retention and acquisition efforts.

- Profitability and Efficiency Issues: The consistent negative EBIT and net income figures suggest that the company may require significant restructuring, including cost-cutting measures and operational efficiencies, to return to profitability.

- Cash Flow and Liquidity Concerns: While EBITDA and cash flow remain positive, the declining trend indicates that Vodafone Italia’s financial health is weakening. Addressing operational inefficiencies and exploring new revenue streams are crucial to reversing this trend.

Recommendations

- Strategic Review: Vodafone Italia should conduct a strategic review to identify the underlying causes of revenue decline and operational inefficiencies. This could involve market analysis, customer segmentation studies, and an assessment of its competitive positioning.

- Cost Optimization Programs: Implementing cost optimization programs to reduce unnecessary expenses without compromising service quality is critical. The company should explore technology investments to automate processes and enhance efficiency.

- Diversification of Revenue Streams: Vodafone Italia could explore new revenue streams, such as digital services, partnerships, and bundling offers, to attract new customers and retain existing ones in a competitive market.